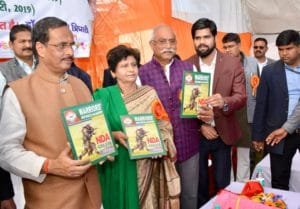

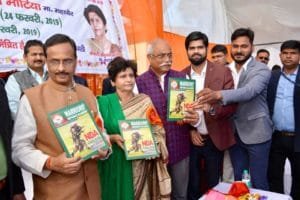

Best NDA Coaching in Lucknow | Top NDA Coaching in Lucknow

WDA is the best NDA Coaching in Lucknow India. We are the Leading NDA/CDS Coaching in Lucknow. When some of the most experienced defence career coaches gathered, the Warriors’ Defence Academy came into existence. We are a team of career coaching experts, who provide complete grooming to aspirants who appear for written examination for NDA and CDSE and SSB interviews to become defence officers.

Warriors Defence Academy | Best NDA Coaching in Lucknow | Best Airforce Coaching in Lucknow | Best Defence Coaching in Lucknow India.

Address: 545-GA/1-CHHA, beside Madhuwan Guest house Chandganj Near Railway crossing, Kapoorthla, Lucknow, Uttar Pradesh 226006

Phone: 07081011964

Unlocking Value in Brownfield Projects via Private Sector

THE GOVERNMENT on Monday unveiled a four-year National Monetisation Pipeline NMP) worth an estimated Rs 6 lakh crore. It aims to unlock valise in brownfield projects by engaging the private sector, transferring to them revenue rights and not ownership in the projects, and uang the funds so generated for infrastructure creation across the country.

The NMP has been announced to provide a dear framework for monetisation and give potential investors a ready list of assets to gen- erate investment interest. The government has stressed that these are brownfield assets which have been “de-risked from execution risks, and therefore should encourage private investment Structuring the monetisation transactions providing a balance risk profile of assets and effective execution of the NMP will be key challenges.

What is Monetization?

In a monetisation transaction, the government is basically transferring revenue rights to private parties for a specified transaction period in return for upfront money, a revenue share, and commitment of investments in the assets. Real estate investment trusts (REITS) and infrastructure investment trusts (InviTs) for instance, are the key structures used to monetise assets in the roads and power sectors. These are also listed on stock exchanges providing investors liquidity through secondary markets as well. While these are a structured financing vehicle, other monetisation models on PPP (Public Private Partnership) basis include: Operate Maintain Transfer (OMT), Toll Operate Transfer (TOT), and Operations, Maintenance & Development (OMD) OMT and TOT have been used in high ways sector while OMD is being deployed in case of airports. Finance Minister Nirmala Sitharaman said: “There is no land here, this entire (NMP) is talking about brownfield projects where investments have already been made, where there is a completed asset which is either languishing or it is not fully monetised or is underutilized. So by bringing in private participation in this you will be able to monetise it better and ensure further investment in infra-structure building.

What is the government’s plan?

Roads, railways and power sector assets will comprise over 66% of the total estimated value of the assets to be monetised, with the remaining upcoming sectors including telecom, mining, aviation, ports, natural gas and petroleums. In terms of annual phasing petroleum product pipelines, 15% of assets with an indicative value of Rs 0.88 lakh crore are envisaged for rollout in the current financial year. The NMP will run coterminous with the National infrastructure pipeline of Rs 100 lakh crore announced in December 2019. The estimated amount to be raised through monetization is around 14% of the proposed outlay for the Centre of Rs 43 lakh crore under NIP.

What is the list of assets?

The assets on the NMP list include: 26,700 km of roads, railway stations, train operations and tracks, 2,8608 Ckt km worth of power the NMP roadmap are: lack of identifiable rev transmission lines, 6 GW of hydroelectric and enues streams in various assets, level of capac- solar power assets, 2.86 lakh km of fibre assets and 14917 towers in the telecom sector, 8,154 km of natural gas pipeline. In the roads sector, the government has already monetized 1,400 km of national highways worth Rs 17,000 core. Another five assets have been monetized through a PowerGrid InvIT raising Rs 7,700 crore.

Also, 15 railway stations, 25 airports and the stake of central government in existing air- minus with the National Infrastructure ports and 160 coal mining projects, 31 projects in 9 major ports, 210 lakh MT of warehousing assets 2 national stadia and 2 regional centers, will be up for monetization. Redevelopment of various government colonies and hospitality assets including TDC hotels is expected to generate Rs 15,000 crore.

#bestndacoachinginlko #ndacoaching #ndaacademy

What are the challenges?

Among the key challenges that may affect the MNP roadmap are; lack of identification revenues streams in various assets, level of capacity utilization in gas and petroleum pipeline networks, disputes resolution mechanism, regulated tariffs in power sector assets, and low interest among investors in national highways below four lanes. While the government has tried to address these challenges in the NMP framework, execution of the plan remains key to its success. Structuring of monetization transactions is being seen as key. The slow pace of privatization in government companies including Air India and BPCL, and less-than-encouraging bids in the recently launched PPP initiative in trains, indicate that attracting private investors interest is not that easy.

“Monetisation potential of toll road assets, though being a market-tested asset class with established monetisation models, is limited by the percentage of stretches having fourlane. and above configuration. The total length of national highway (NH) stretches with four.. lane and above is estimated to be about 23% of the total NH network,” as per the NMP frame work. The government has tried to address this with a plan to monetize assets that are four lane and above.

The MNP framework notes that other key impediments to the monetisation process are asset-specific challenges such as presence of an identifiable revenue stream. This is specifi cally relevant to the railway sector, which has seen limited PPP success as a mode of project delivery.

Konkan Railway, for instance, has multiple stakeholders, including state governments, which own a stake in the entity, Creating an effective monetization transaction structure could be a bit challenging in this case.

CONTENT BY PRASHANT SINGH

Faculty of personality development | 5+ years of experience of teaching | Masters in English literature | 10 times CDS qualified, | Defence enthusiast, educator and explorer